tax sheltered annuity 501(c)(3)

As an employee of a school religious organization hospital or Section 501c3 nonprofit organization you have a unique opportunity to regularly set aside. Nonprofit organizations that qualify under 501 c3 of the IRS code may offer TSA plans to their employees.

Are you employed by an educational institution church or nonprofit.

. 3 An organization in either. The terms tax-sheltered annuity and 403 b are often used interchangeably. When these organizations as well as similarily exempt state and local educational institutions purchase tax-sheltered annuities for their employees those annuity payments are.

If so theres a retirement savings program authorized by section 403b of the Internal Revenue Code that. An organization in either of these two categories. There are 5 important reasons why Tax Sheltered Annuities are a great investment.

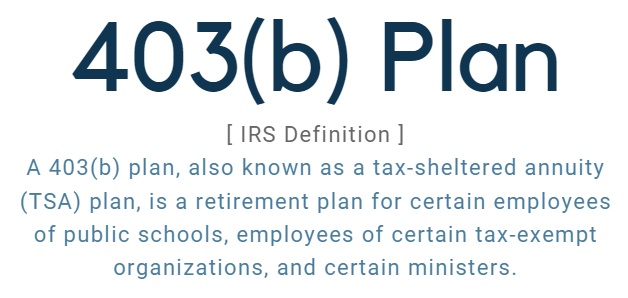

A 403b plan also known as a taxsheltered annuity TSA plan is a retirement plan for cer. These organizations are usually referred to as section 501 c 3 organizations or simply 501 c. Employees of tax-exempt organizations established under section 501 c 3.

Established under section 501c3. A Tax Sheltered Annuity also called a TSA or 403b is a retirement plan offered by public schools and certain 501 c3 tax-exempt nonprofit organizations. Section 403b excludes from the federal gross income of employees of public school systems and organizations exempt from tax under Section 501c3 of the Code contributions by the.

TSA as Defined by IRS The Internal Revenue Code 403B Tax-Sheltered Annuity Plan is a retirement plan. These organizations are usually referred to as section. An organization must be either a tax-exempt organization of one of the types described in IRC Section 501c3 or a public school system.

1 a tax-exempt organization of one of the types described in IRC Section 501 c 3 or 2 a public school system. The organization must be either. According to the IRS a 403 b plan or tax-sheltered annuity TSA differs from a 401 k in that it can only be offered by public schools and certain tax-exempt organizations.

TSA is a savings program that allows additional savings that can be used to supplement retirement. There are however various differences between the TSA and IRA. A tax-sheltered annuity or TSA is a long-term retirement planning strategy that provides a systematic tax-sheltered approach to accumulate money for your retirement.

Npo Tax Issues And Concerns C Suny Old Westbury Presentation

What You Should Know About Tax Sheltered Annuities The Motley Fool

Retirement Plans What You Need To Know About 403 B Plans Policy Smart

403b Tsa Annuity For Public Employees National Educational Services

Who Uses A 403 B Plan Part One By Admin Partners Llc Medium

What Is A 403 B For Nonprofits Instrumentl

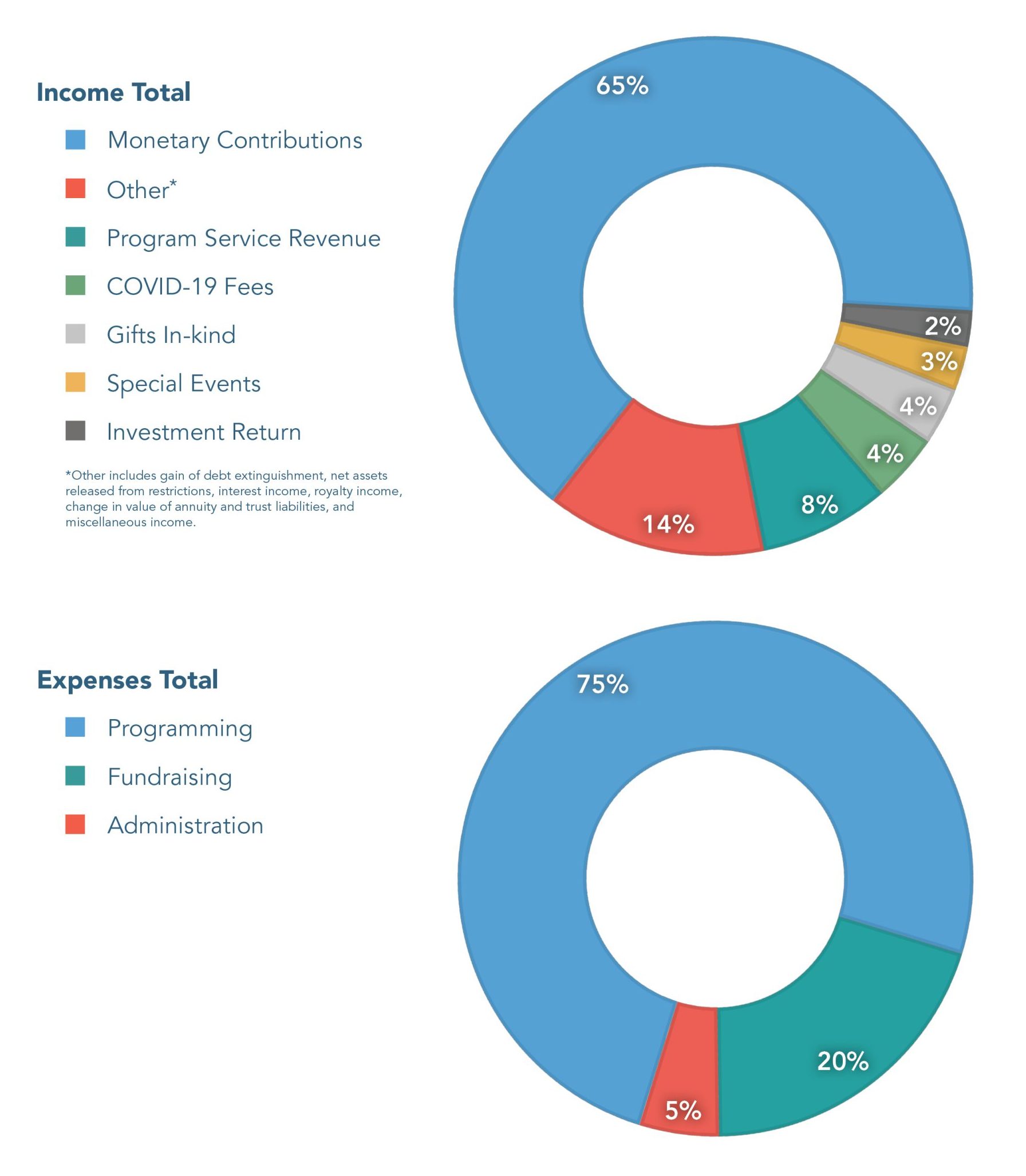

Financials Homeless Shelter For Women Homeless Shelter For Men In

Retirement Plan Options For Nonprofit Organizations Employees Truenorth Retirement Services

What Is A 403b Tax Shelter Annuity And How Does It Work

The Tax Sheltered Annuity Tsa 403b Calculator

2022 2023 401k 403b 457 Ira Fsa Hsa Contribution Limits

Module 6 403 B Plans Other Plan Issues Ppt Download

Tax Sheltered Annuities What Are They And Who Are They For

What Is A Tax Sheltered Annuity Due

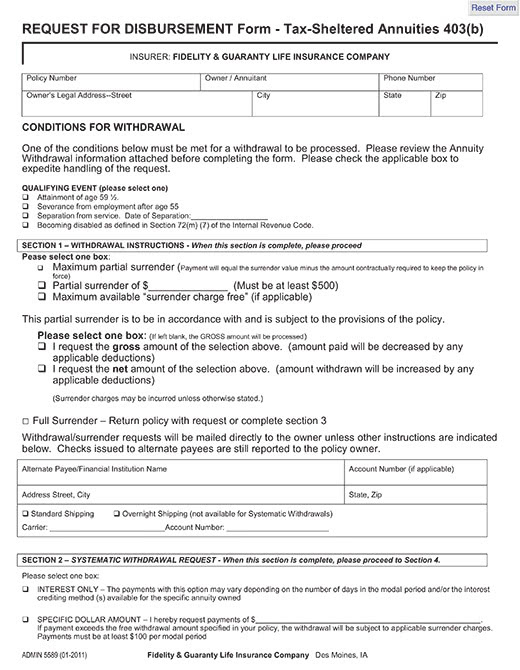

Withdraw From Tax Sheltered 403 B Contract F G

Registration Statement Including A Prospectus N 4

403 B Or 401 K A Choice For Tax Exempt Organizations Independent Retirement

:max_bytes(150000):strip_icc()/Safe-Retirement-Withdrawal-Rate-57a521625f9b58974aa2b94a.jpg)